AI is revolutionizing trading , offering traders innovative instruments to analyze data , forecast trends , and perform trading operations with unparalleled efficiency and precision . From machine learning models to NLP capabilities , advanced algorithms are redefining strategic choices . Throughout this article , we’ll break down what AI-powered trading encompasses , how it works , and the merits and limitations of this groundbreaking approach.

AI in trading uses a combination of key technologies, including ML-based techniques , natural language processing , and large-scale data processing to automate data analysis and strategic implementation. It also enables rapid backtesting of trading strategies, which can save time and money while advancing the refinement of more profitable and risk-adjusted approaches.

The machine learning market is evolving at a rapid pace, spurred on by a synergy between novel digital research, heightened capital inflows , and need for improved trading results among investors and financial professionals. As highlighted in a recent analysis, the digital trading market is poised to grow at click here an astounding compound annual growth rate of over 38% between 2023 and 2028 . Even with this growth, there are still some hurdles that must be overcome in order to completely unlock the potential check out this information of best broker this game-changing tool.

Although AI has the potential to lower human subjectivity , it cannot replace the intuition , creative thinking, and innovative capacity that is crucial for effective trading decisions . Instead, it is better to see it as a complementary mechanism to help you adapt rapidly and decisively to promising market scenarios and reduce your exposure to risk.

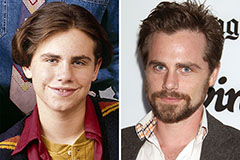

Rider Strong Then & Now!

Rider Strong Then & Now! Tatyana Ali Then & Now!

Tatyana Ali Then & Now! Melissa Joan Hart Then & Now!

Melissa Joan Hart Then & Now! Raquel Welch Then & Now!

Raquel Welch Then & Now! Terry Farrell Then & Now!

Terry Farrell Then & Now!